The Challenge: Receiving Payments from Russian Clients

If you run a business or provide a service with clients in Russia, you may have encountered difficulties receiving payments. Since 2022, financial sanctions, banking restrictions, and the removal of Russian banks from the SWIFT system have made international transactions increasingly complex. Many global companies now struggle to process payments from Russian customers for subscriptions, software, consulting services, and other digital or physical goods.

What Do Russian Clients Need to Pay For?

Despite restrictions, Russian consumers and businesses continue to seek access to international services and products. Some of the most common expenses include:

- Business and IT Services – SaaS platforms, cloud storage, software licenses (e.g., AWS, Google Workspace, Microsoft 365, Adobe Creative Cloud).

- Digital Marketing & Subscriptions – Google Ads, Meta (Facebook, Instagram) Ads, LinkedIn Premium, SEO tools like Ahrefs and Semrush.

- Educational Platforms – Online courses, professional certifications (Coursera, Udemy, Skillshare, MasterClass).

- Streaming & Entertainment – Netflix, Spotify, Apple Music, gaming platforms like Steam and PlayStation Network.

- E-commerce and Hosting – Shopify, domain registrations, website hosting, payment processing tools.

- Professional Services – Consulting, legal support, outsourced development, and design services.

Why Can’t Russian Clients Pay Directly?

There are several reasons why Russian customers face difficulties when making international payments:

- Banking Restrictions – Many Russian banks are disconnected from SWIFT, preventing direct wire transfers.

- Blocked Payment Processors – Services like PayPal, Stripe, Wise, and Revolut have ceased operations in Russia.

- Sanctions and Compliance Issues – International companies must comply with regulatory restrictions, preventing them from processing Russian transactions.

- Card Payment Limitations – Visa, Mastercard, and American Express no longer work for international purchases from Russia.

- Currency Conversion Issues – Even when alternative payment methods exist, high conversion rates and extra fees make transactions costly.

Are Payment Restrictions a Global Issue?

While Russia faces the most severe international payment restrictions, businesses may also struggle with payments from customers in other sanctioned or high-risk regions, including:

- Iran – Limited access to international banking networks.

- Venezuela – Sanctions impact financial transactions.

- Turkey & Argentina – High inflation and strict capital controls complicate foreign payments.

- China – Regulatory barriers for cross-border transactions.

Available Payment Solutions for Russian Clients

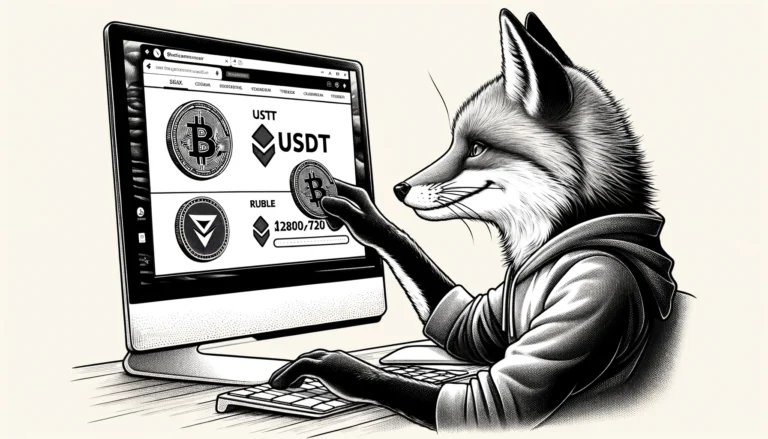

1. Cryptocurrency Payments

Many Russian businesses and freelancers use USDT, Bitcoin, or Ethereum for cross-border payments. However, crypto transactions can be volatile and face legal uncertainties.

- Pros: Fast, decentralized, and often lower fees.

- Cons: Regulatory risks, conversion challenges, and tax implications.

2. P2P Transfers via Friendly Countries

Payments routed through countries like Kazakhstan, Armenia, or the UAE allow Russian clients to access international financial systems.

- Pros: Can enable bank transfers and card payments.

- Cons: Requires intermediaries and additional steps.

3. Alternative Payment Platforms

Some Russian fintech services offer international payment workarounds, but they often come with high fees and unpredictable availability.

- Examples: QIWI, YooMoney (formerly Yandex.Money), and MIR cards in select regions.

- Cons: Limited international acceptance and potential compliance risks.

The Best Solution: Pay Invoices with Nowall

For businesses struggling to receive payments from Russian clients, Nowall provides a reliable, compliant, and hassle-free solution.

How Nowall Helps:

- Legally compliant transactions, ensuring smooth payments from Russian customers.

- Fast processing with competitive exchange rates.

- Multiple payment options tailored to different business needs.

- Secure and transparent transactions without hidden fees.

Many companies have already switched to Nowall to streamline payments from Russia. Whether you need to collect payments for services, subscriptions, or large invoices, our solution ensures your transactions remain uninterrupted.

To learn more about how to receive payments from Russian clients, visit https://nowall.eu/services/invoices/.

Conclusion

With international payment restrictions in place, businesses need alternative solutions to continue serving Russian clients. While crypto, P2P transactions, and alternative payment services offer temporary fixes, Nowall provides a secure, compliant, and efficient way to receive payments. Start accepting payments hassle-free today with Nowall.